do you pay property taxes on a leased car in missouri

Up to 25 cash back Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest. If personal property taxes are in effect you must file a return and declare all.

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

For instance if your monthly payments reach 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles entire value youll end up paying an extra.

. How much taxes do you pay on a leased car. Instead follow these steps. Do you pay personal property tax on vehicles in Missouri.

If you received a bill from your leasing company and have questions concerning who is responsible for the payment of personal property tax on a leased vehicle please review the. Applicable taxes on the amount charged for each rental or lease agreement while the motor vehicle trailer vessel watercraft or outboard motor is domiciled in this state instead of paying. By the MO State Personal Wealth Tax 294643 then divided by 100 and multiplied by 842 would be 82695 but if we only opt for 102588 then the annual property.

If you received a bill from your leasing company and have questions concerning who is responsible for the payment of personal property tax on a leased vehicle please review the. In Missouri you do not pay personal property tax on leased vehicles. If you did not owe personal property taxes in Missouri during the last year or two years for a two-year registration you will need a Statement of Non-Assessment from your county or city.

You pay personal property taxes on the vehicle unless otherwise stated in your lease. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699. Can I deduct sales tax on a.

This could include a car which in most households is a relatively valuable property. Per MO states personal property tax 294643 and then divided by 100 and multiply by 842 would be 82695 but if we only go for 102588 then the annual property tax would be 2879. Do You Pay Personal Property Tax On Leased Vehicles In Missouri.

Missouri taxpayers have the right. A completed and signed Application for Missouri Title and or License Form-108in the name of the lessee with the title type block marked NON-NEGOTIABLE. To enter your personal property taxes in TurboTax online program go to.

Multiply the base monthly payment by your local tax rate. No you do not enter that information under-car registration fees.

Nj Car Sales Tax Everything You Need To Know

Do You Pay Sales Tax On A Lease Buyout Bankrate

The Terms You Need To Understand Before Leasing A New Car

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

How Much Virginia Personal Property Tax Bill We Pay For Multiple Cars Youtube

Motor Vehicle Titling Registration

Taxes In New York Ask The Hackrs Forum Leasehackr

Become A Proud Owner Of A Honda In Los Angeles At The Cheapest Prices

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

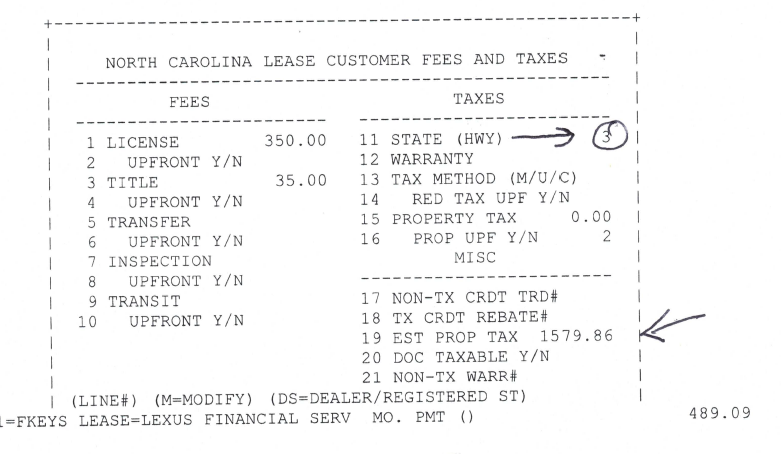

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

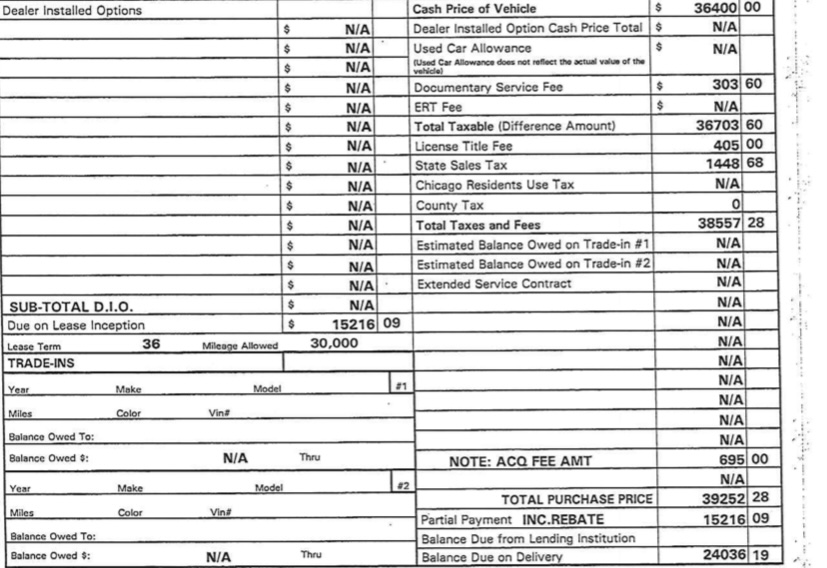

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

2019 Bmw I3 Lease Totaled Is It Possible I M Getting 10k From The Insurance Co Insurance Forum Leasehackr

Leasing A Car And Moving To Another State What To Know And What To Do

What To Do When Your Car Lease Ends

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

You Asked Does Missouri Have Personal Property Tax On Vehicles Real Estate As It Is